PDR benefits, or Plastic Deformation Repair, are cost-effective ways to fix cosmetic vehicle damage, preserving aesthetics and resale value while promoting sustainability by minimizing waste. Insurance plays a vital role in covering these costs, offering peace of mind, preventing financial strain, and encouraging responsible vehicle maintenance. By simplifying PDR claim processes, insurance companies help policyholders choose preferred repair shops and ensure prompt reimbursement, leading to faster restoration of vehicles to pre-accident condition.

In today’s uncertain world, understanding and leveraging PDR benefits is crucial for financial security. This article delves into the intricate role of insurance in supporting these benefits, offering a comprehensive overview. We explore how insurance protects personal assets, facilitates seamless claims navigation, and ultimately enables smooth reimbursement for PDR benefits. By the end, readers will grasp the importance of insurance in managing and securing their well-being.

- Understanding PDR Benefits: A Comprehensive Overview

- Insurance's Key Role in Protecting Personal Assets

- Navigating Claims: How Insurance Facilitates PDR Reimbursement

Understanding PDR Benefits: A Comprehensive Overview

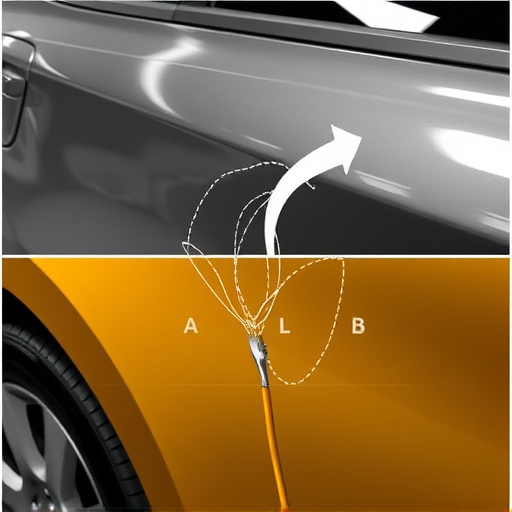

PDR benefits, or Plastic Deformation Repair, represent a crucial aspect of automotive care that focuses on correcting cosmetic dents and scratches. This process involves specialized techniques to return damaged vehicle surfaces to their original condition, enhancing aesthetics and resale value. PDR benefits extend beyond mere visual improvements; it also helps maintain the structural integrity of a vehicle’s body panel.

Understanding PDR benefits further reveals its economic advantages. By opting for frame straightening and tire services along with body shop repairs, individuals can save significant costs compared to complete body shop overhauls. This cost-effectiveness makes PDR an appealing choice for those seeking to preserve their vehicle’s value while keeping maintenance expenses in check. Moreover, the eco-friendly aspect of PDR, which minimizes waste and reduces the need for extensive material replacement, aligns with modern sustainability goals.

Insurance's Key Role in Protecting Personal Assets

Insurance plays a pivotal role in safeguarding personal assets, particularly when it comes to protecting vehicles and their owners from financial burdens associated with damages. In today’s world, where accidents and incidents like car scratches, dents, or even more severe bumper repairs are common, insurance acts as a shield against these unforeseen events. It provides peace of mind by covering the costs of such repairs, ensuring that policyholders can maintain their vehicles without facing substantial financial challenges.

By offering PDR benefits (including bumper repair, car dent repair, and car scratch repair), insurance companies empower individuals to keep their vehicles in excellent condition. These benefits are designed to encourage timely maintenance and repair, preventing minor issues from escalating into more costly problems. Thus, insurance not only supports the smooth functioning of personal assets but also promotes responsible ownership by offering financial security and accessibility to essential repair services.

Navigating Claims: How Insurance Facilitates PDR Reimbursement

Navigating claims processes can be a complex task, especially when it comes to understanding reimbursement for Pre-Determined Repair (PDR) benefits. Insurance companies play a pivotal role in simplifying this process and ensuring smooth compensation for policyholders involved in minor accidents, such as fender benders or bumper repairs. By offering PDR benefits, insurance providers give policyholders the flexibility to choose their preferred auto repair near me without facing extensive deductibles.

When a policyholder decides on an approved auto repair shop, the insurance company steps in to facilitate reimbursement for the agreed-upon repairs. This streamlined process not only saves time but also reduces the financial burden often associated with unexpected incidents like a minor crash. Insurance acts as a bridge, connecting policyholders with their chosen repair centers and ensuring that PDR benefits are utilized effectively, allowing for faster restoration of vehicles to their pre-accident condition.

Insurance plays a pivotal role in supporting and protecting individuals’ PDR (Personal Damage Repair) benefits. By understanding these benefits and navigating claims effectively, insurance providers facilitate reimbursement for eligible repairs. This ensures that policyholders can access necessary resources to restore their properties, offering peace of mind and financial security. In today’s digital era, where property damage can occur due to various unforeseen circumstances, having robust insurance coverage is more crucial than ever to safeguard personal assets.